|

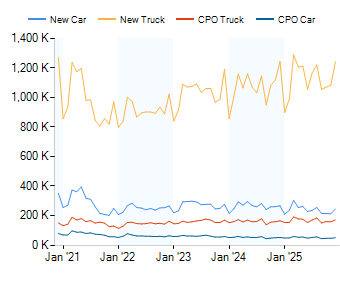

NEW & CPO VEHICLE SALES

NEW VEHICLE SALESDEC 2025

| BRAND | CAR | TRUCK | ALL |

| Acura | 2,322 | 9,521 | 11,843 |

| Alfa Romeo | 70 | 288 | 358 |

| Aston Martin | 118 | 57 | 175 |

| Audi | 4,037 | 9,833 | 13,870 |

| Bentley | 185 | 100 | 285 |

| BMW | 12,975 | 29,507 | 42,482 |

| BrightDrop | | 20 | 20 |

| Buick | | 16,425 | 16,425 |

| Cadillac | 2,058 | 12,962 | 15,020 |

| Chevrolet | 2,345 | 163,728 | 166,073 |

| Chrysler | 5 | 10,692 | 10,697 |

| Dodge | 335 | 11,383 | 11,718 |

| Ferrari | 222 | 102 | 324 |

| Fiat | 19 | 8 | 27 |

| Ford | 4,463 | 187,548 | 192,011 |

| Genesis | 1,531 | 6,936 | 8,467 |

| GMC | | 64,685 | 64,685 |

| Honda | 33,860 | 72,956 | 106,816 |

| Hyundai | 17,690 | 61,240 | 78,930 |

| Ineos | | 531 | 531 |

| Infiniti | | 5,352 | 5,352 |

| Jaguar | 67 | 505 | 572 |

| Jeep | | 47,974 | 47,974 |

| Kia | 19,704 | 55,299 | 75,003 |

| Lamborghini | 59 | 198 | 257 |

| Land Rover | | 7,259 | 7,259 |

| Lexus | 5,760 | 32,473 | 38,233 |

| Lincoln | | 11,811 | 11,811 |

| Lotus | 97 | 3 | 100 |

| Lucid | 1,768 | 647 | 2,415 |

| Maserati | 23 | 109 | 132 |

| Mazda | 3,216 | 29,394 | 32,610 |

| McLaren | 120 | | 120 |

| Mercedes-Benz | 8,092 | 24,936 | 33,028 |

| MINI | 1,281 | 1,174 | 2,455 |

| Mitsubishi | 263 | 9,187 | 9,450 |

| Nissan | 22,532 | 54,135 | 76,667 |

| Polestar | 8 | 372 | 380 |

| Porsche | 2,636 | 4,135 | 6,771 |

| Ram | | 49,014 | 49,014 |

| Rivian | | 3,606 | 3,606 |

| Rolls Royce | 119 | 36 | 155 |

| Subaru | 19,951 | 37,486 | 57,437 |

| Tesla | 13,524 | 34,776 | 48,300 |

| Toyota | 58,169 | 135,111 | 193,280 |

| VinFast | | 118 | 118 |

| Volkswagen | 4,499 | 24,836 | 29,335 |

| Volvo | 20 | 14,173 | 14,193 |

| ***Total*** | 244,143 | 1,242,736 | 1,486,879 |

Updated: 1/16/2026 10:15 AM

MI IN THE MEDIA

|

Monthly EV Sales Overview

read a complimentary copy today

The EV Sales Overview highlights the top electric vehicle news along with a summary of their sales performance over the last year.

Click here to read a recent complimentary copy.

MIS UPDATES

December 2025 New Vehicle Unit Sales, SAAR, Inventory, CPO Sales and Incentives Spending results are now available for query. All brands are now finalized.

- December 2025 Production data is now available to query. 1/26/2026

- Incentives, lease payments, lease rates and residual values are now available for all brands. 1/20/2026

- CPO / PO Incentives are now available for all brands. 1/20/2026

- Lease rates and residual values are now available for BMW, Ford, Mini, and Mitsubishi. 1/13/2026

- Lease payments are now available for Ford, Lincoln, Mazda, Tesla, Toyota (Los Angeles Region), and Volkswagen (Northeast Region). 1/13/2026

INCENTIVE HIGHLIGHTS

2026 TRANSIT: Raised customer cash to $2,500 in many regions (from $1,500). 2026 MUSTANG: Added $1,000 customer Cash on Mustang GT and $500 on I4 in its Cincinnati, Los Angeles, Phoenix and San Francisco regions. 2026 MAVERICK: Added $500 customer cash on Maverick Gas in its Denver region. Effective 1/27/2026 on Maverick, Mustang, Transit. 2026 PILOT: Launched support, including 3.49% special retail financing for up to 36 months, 4.49% for 37-60 months and 5.49% for 61-72 months, $750 conquest / loyalty cash and a special lease program, featuring an advertised payment of $489/month for 36 months with $4,699 due at signing for Pilot Sport 2WD. Effective 1/27/2026 on Pilot. 2025 OUTLANDER: Enhanced special retail financing rates to 0.0% for up to 72 months (from 1.9% for 72 months) and doubled owner loyalty cash to $1,000. Effective 1/26/2026 on Outlander. 2026 AIR: Raised special retail financing rate to 1.99% for up to 72 months (from 0.99%), lowered On-Site vehicle bonus to $2,000 (from $3,000) and increased advertised lease payment by $50 for in stock vehicles, to $599/month for 39 months with $5,519 due at signing for the Air Pure. 2026 GRAVITY: Lowered On-Site vehicle bonus to $4,000 (from $5,000), eliminated $3,000 owner loyalty cash and raised the amount that is due at lease signing on its $749/month advertised payment for the Touring trim to $5,959 (from $4,989). Effective 1/19/2026 on Air, Gravity. 2026 PATHFINDER: Launched with $2,000 customer cash, 0.9% special retail financing for up to 36 months, 1.9% for 60 months, 2.9% for 72 months and 4.9% for 84 months and a special lease program that includes $0 - $1,325 regional lease cash. 2026 ROGUE: Doubled lease cash on Platinum trim to $2,000. 2025 SENTRA: Raised bonus cash to $1,250 (from $500). Effective 1/21/2026 on Pathfinder, Rogue, Sentra.

TRENDING NEWS

|