|

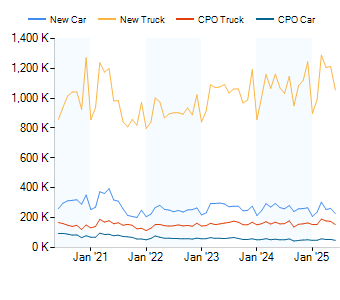

NEW & CPO VEHICLE SALES

NEW VEHICLE SALESJUN 2025

| BRAND | CAR | TRUCK | ALL |

| Acura | 2,135 | 8,777 | 10,912 |

| Alfa Romeo | 89 | 247 | 336 |

| Aston Martin | 91 | 55 | 146 |

| Audi | 3,388 | 9,265 | 12,653 |

| Bentley | 187 | 66 | 253 |

| BMW | 10,431 | 19,584 | 30,015 |

| BrightDrop | | 458 | 458 |

| Buick | | 14,075 | 14,075 |

| Cadillac | 1,634 | 11,593 | 13,227 |

| Chevrolet | 2,581 | 135,839 | 138,420 |

| Chrysler | 37 | 6,395 | 6,432 |

| Dodge | 791 | 6,207 | 6,998 |

| Ferrari | 263 | 41 | 304 |

| Fiat | 71 | 16 | 87 |

| Ford | 4,242 | 169,214 | 173,456 |

| Genesis | 1,617 | 5,206 | 6,823 |

| GMC | | 52,232 | 52,232 |

| Honda | 31,957 | 71,617 | 103,574 |

| Hyundai | 18,208 | 51,494 | 69,702 |

| Ineos | | 410 | 410 |

| Infiniti | 22 | 3,377 | 3,399 |

| Jaguar | 69 | 349 | 418 |

| Jeep | | 44,815 | 44,815 |

| Kia | 17,177 | 46,672 | 63,849 |

| Lamborghini | 149 | 196 | 345 |

| Land Rover | | 7,740 | 7,740 |

| Lexus | 4,625 | 23,449 | 28,074 |

| Lincoln | | 8,144 | 8,144 |

| Lotus | 166 | | 166 |

| Lucid | 840 | | 840 |

| Maserati | 66 | 139 | 205 |

| Mazda | 3,150 | 30,235 | 33,385 |

| McLaren | 85 | | 85 |

| Mercedes-Benz | 7,621 | 22,151 | 29,772 |

| MINI | 1,097 | 1,010 | 2,107 |

| Mitsubishi | 1,000 | 7,436 | 8,436 |

| Nissan | 23,371 | 45,150 | 68,521 |

| Polestar | 41 | 540 | 581 |

| Porsche | 2,711 | 4,150 | 6,861 |

| Ram | | 36,195 | 36,195 |

| Rivian | | 4,003 | 4,003 |

| Rolls Royce | 56 | 87 | 143 |

| Subaru | 14,908 | 31,607 | 46,515 |

| Tesla | 17,583 | 32,654 | 50,237 |

| Toyota | 49,727 | 115,447 | 165,174 |

| VinFast | | 175 | 175 |

| Volkswagen | 5,328 | 17,473 | 22,801 |

| Volvo | 122 | 8,505 | 8,627 |

| ***Total*** | 227,636 | 1,054,490 | 1,282,126 |

Updated: 7/8/2025 1:27 PM

MI IN THE MEDIA

|

Monthly EV Sales Overview

read a complimentary copy today

The EV Sales Overview highlights the top electric vehicle news along with a summary of their sales performance over the last year.

Click here to read a recent complimentary copy.

MIS UPDATES

U.S. Market New Vehicles Sales, SAAR, Inventory, CPO Sales and Incentives Spending results are finalized for June.

- Lease rates and residual values are now available for Ford, Honda, Lexus, and Mitsubishi. 7/15/2025

- Lease price points are now available for all brands. 7/15/2025

- Lease rates and residual values are now available for Audi and BMW. 7/11/2025

- Lease price points are now available for Genesis (Eastern Region), Hyundai (Eastern Region), Tesla, and Volvo. 7/11/2025

- Lease rates and residual values are now available for Chrysler, Dodge, GMC, Jeep, Ram, and Subaru. 7/10/2025

- Lease price points are now available for Ford, Ineos, Kia, Lucid, Nissan, Polestar, Rivian, Toyota (Denver Region), VinFast, and Volkswagen (Northeast Region). 7/10/2025

- Incentives are now available for all brands. 7/10/2025

- Lease rates and residual values are now available for Genesis, Infiniti, and Mercedes-Benz. 7/9/2025

- Lease price points are now available for Honda, Infiniti, and Mini. 7/9/2025

- Incentives are now available for Ford, Honda, Kia, and Porsche. 7/9/2025

- Lease rates and residual values are now available for Kia, Lincoln, and Porsche. 7/8/2025

- Lease price points are now available for Audi and BMW. 7/8/2025

- Incentives are now available for Genesis, Hyundai, Infiniti, Lincoln, and Nissan. 7/8/2025

INCENTIVE HIGHLIGHTS

2025 WRANGLER: Added $1,500 lease loyalty bonus cash on Wrangler 4xe excluding High Altitude in its West Business Center. Effective 7/10/2025 on Wrangler. 2025 ALL MODELS: Replaced last month's 'Ford Motor Company From America, For America' employee-pricing-for-all campaign with a new 'Summer Sales Event Zero, Zero, Zero' offer which provides zero down payment, 0% interest and zero payments for 90 days on most Ford vehicles. 2025 AVIATOR, NAUTILUS, NAVIGATOR: Enhanced special lease rates. 2025 CORSAIR PHEV: Raised lease cash to $5,500 (from $2,750). Effective 7/8/2025 on all Lincoln vehicles. 2025 ALL MODELS: Replaced last month's 'Ford Motor Company From America, For America' employee-pricing-for-all campaign with a new 'Summer Sales Event Zero, Zero, Zero' offer which provides zero down payment, 0% interest and zero payments for 90 days on most Ford vehicles. 2025 BRONCO, BRONCO SPORT, ESCAPE, ESCAPE HYBRID, ESCAPE PHEV, EXPLORER, F-150 GAS: Added $1,000 lease cash. 2025 MUSTANG: Added $500 - $1,500 customer cash and $1,000 lease cash. 2025 BRONCO: Added $1,000 customer cash. 2025 MUSTANG MACH-E, F-150 LIGHTNING: Added $1,000 retail bonus cash. 2025 TRANSIT: Added $1,500 customer cash. 2026 ESCAPE, ESCAPE HYBRID, ESCAPE PHEV: Launched with $1,000 bonus cash on Escape / Escape Hybrid and $2,000 on Escape PHEV. 2025 ALL MODELS: Introduced a complimentary 2 Year / 25,000 Mile Premium Maintenance Plan on mode models. Effective 7/8/2025 on all Ford division vehicles. 2025 EV6: Raised customer cash to $5,000 (from $3,000 in June), enhanced special retail financing rates to 0.0% - 2.49% (from 1.9% - 3.49% in June) and improved regional advertised lease payments by $20 - $30/month, to as low as $269/month for 24 months with $3,999 due at signing. 2025 EV9: Raised customer cash to $5,000 (from $4,000). 2025 CARNIVAL, CARNIVAL HYBRID, NIRO, SELTOS, SORENTO, SPORTAGE, SPORTAGE HYBRID: Introduced $500 - $1,000 APR bonus cash. 2026 K5: Launched with 3.9% - 5.25% special retail financing and a special lease program, featuring advertised payments as low as $299/month for 36 months with $3,499 due at signing. 2026 SELTOS: Launched with 3.9% - 5.25% special retail financing and a special lease program, featuring advertised payments as low as $249/month for 36 months with $3,499 due at signing. 2026 SPORTAGE HYBRID: Launched with 3.49% - 5.49% special retail financing and a special lease program, featuring advertised payments as low as $309/month for 36 months with $3,999 due at signing. 2026 SPORTAGE: Enhanced special retail financing rates to 1.9% - 4.49% (from 2.9% - 4.99%) and lowered advertised lease payment by $20/month in enhanced states, to $269/month for 36 months with $3,999 due at signing. 2026 CARNIVAL: Lowered advertised lease payment by $10/month, to $429/month for 36 months with $3,999 due at signing. 2025 SPORTAGE: Lowered advertised lease payment by $10/month, to $239/month for 24 months with $3,999 due at signing. 2025 SPORTAGE HYBRID: Lowered advertised lease payment by $20/month to $289/month for 36 months with $3,999 due at signing. 2025 NIRO: Lowered advertised lease payment by $20/month to $249/month for 36 months with $3,499 due at signing. 2025 ALL MODELS: Eliminated the 'Summer Sticker Sales Event' cash that was available on select models last month. 2026 / 2025 ALL MODELS: Extended most other programs through 8/4/2025. Effective 7/8/2025 on all Kia vehicles. 2026 QX60: Added $1,650 regional lease cash in its Miami, Tampa and West Palm Beach DMAs. 2026 QX60: Added $2,600 regional lease cash in its New York DMA. 2025 QX50: Added $1,000 regional lease cash on QX50 LUXE AWD in many DMAs. 2025 QX80: Added $2,000 regional lease cash in its Miami, Orlando, Tampa, Fort Myers, Naples, Philadelphia, Boston, Cleveland, Akron, Detroit, Chicago, Phoenix and Los Angeles DMAs. 2026 / 2025 ALL MODELS: Extended all other programs programs, including a number that came out on July 1st, through 8/4/2025. Effective 7/8/2025 on all Infiniti vehicles.

TRENDING NEWS

- Tesla’s Model Y debuts in India priced at a hefty $70,000 as the EV maker ‘tests the waters’

Tesla has made its long-awaited debut in India, where it has launched a new showroom... CNBC on 07/15/2025

- GM, LG to upgrade Tennessee plant to make low-cost EV batteries

Ultium Cells — a joint venture between General Motors and LG Energy Solution — is upgrading its Spring Hill, Tennessee, facility to make low-cost EV battery cells... CNBC on 07/14/2025

- Used-vehicle retail sales dip slightly in June

Used-vehicle sales declined slightly in June while certified pre-owned volume fell dramatically amid seasonal shifts and fewer selling days... CBT News on 07/14/2025

- GM idles truck plant in Mexico for several weeks

GM’s assembly complex in Silao, Mexico, where the company builds the Chevrolet Silverado and GMC Sierra pickups, was down for the first two weeks of July, and is scheduled to be idled again the weeks of August 4 and 11, two people familiar with the matter told Reuters... Automotive News on 07/12/2025

- Tesla slashes prices in Canada despite tariffs as sales basically go to 0

Tesla announced that it is reducing the price of the Model Y by about $20,000 in Canada... electrek on 07/11/2025

|